When Will Huntington Bank Deposit Stimulus Checks

Huntington Bank will deposit stimulus checks on the same day as the IRS releases them. The IRS has not yet announced a release date for the third stimulus check, so Huntington Bank cannot provide an exact date for when the checks will be deposited. However, they expect to deposit the checks within 24 hours of the IRS release.

How Can I Deposit My Money To Huntington Bank?

Before depositing, we should familiarize ourselves with the basics of Huntington Bank. Established in 1866, Huntington Bank is a prominent financial institution with a long experience providing secure and efficient service to its millions of customers throughout the United States. They offer various financial services and products, such as savings and checking accounts, mortgages, loans, investment options, and credit cards.

1. The Importance of Depositing Money at Huntington Bank

If you’re a customer at Huntington Bank, depositing money is an essential step that allows you to manage your finances effectively. If you’re depositing your pay or cash, ensuring that your money is safely deposited into your account is vital to conducting day-to-day transactions, paying your bills, and reaching your financial objectives.

2. Ways to Deposit Money at Huntington Bank

Huntington Bank offers various convenient ways to deposit money and caters to different customers’ preferences and requirements. Let’s look at these options for deposit:

Direct Deposit

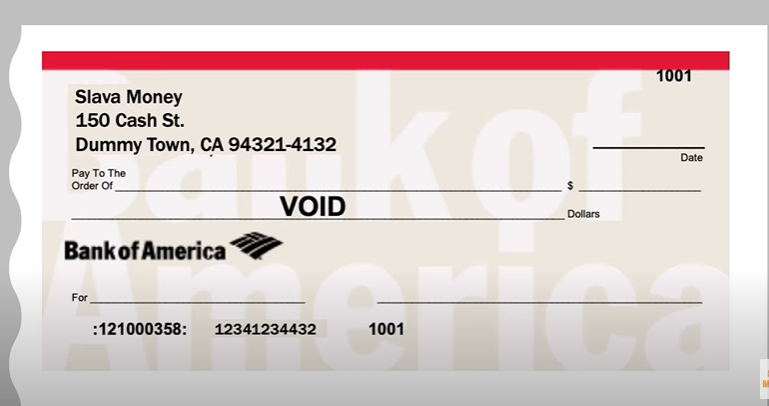

Direct deposits are a safe and efficient method of transferring your regular income, like paychecks or government benefits, directly to the Huntington Bank account. Contact your employer or bank with the Huntington Bank account number and routing number to establish direct deposit.

Mobile Check Deposit

Utilizing the latest technological advances, Huntington Bank allows you to make check deposits using their mobile banking application. The process is simple and requires you to take a photo of the back and front of the check, put in the amount to deposit, and then send it to the application. This process reduces time and effort since you can deposit checks in the comfort of your home.

ATM Deposits

Huntington Bank has an extensive network of ATMs that make it easy to deposit checks and cash. Find a Huntington Bank ATM near you and add the debit card you have, then follow the instructions on the screen, and make sure you deposit your money securely.

In-Person Deposits

To get a more personalized experience, visit the nearest Huntington Bank branch to make deposits with cash or checks. The knowledgeable and friendly bank employees will assist you in depositing and ensuring your money is transferred to your account on time.

Electronic Funds Transfer (EFT)

If there are funds in a different bank account, or you wish to transfer funds from an outside source to the Huntington Bank account, you can use Electronic Funds Transfer (EFT). Enter the information required, then the transfer can take place safely.

3. Tips for a Smooth Deposit Process

For a smooth and efficient process for depositing for deposits at Huntington Bank, be sure to consider the following suggestions:

Accurate Information

Double-check the numbers of your account and the routing numbers when making a direct deposit or electronic funds transfer. Inaccurate information could cause delays or problems regarding your deposit.

Endorse Checks Correctly

When depositing checks, you must endorse them by signing them with your signature. Also, mark the wording “For Deposit Only” to stop unauthorized individuals from cashing or transferring the check.

Deposit Cut-Off Times

Be aware of your deadlines for deposit deposits at your bank. If you deposit after the cut-off time can be processed the following day’s business.

Availability of Funds

Learn the bank’s policies regarding the availability of funds. Certain deposits might be subject to a hold time before the funds are available to withdraw.

Keep Records

Keep track of your bank deposits, including the receipts and confirmation number or other transaction information. These documents can prove valuable for reference in the future or even dispute resolution.

The Date When Did The Irs Stop Accepting Direct Deposits On Stimulus Checks?

We look into the critical issue that many taxpayers are asking “When did the IRS stop allowing direct deposit on stimulus checks?” As a top source for extensive information, we endeavor to give you the most accurate and current solution to help you know the latest changes to IRS guidelines regarding direct deposit for stimulus checks. Let’s take a deep dive into this!

1. The Evolution of the IRS Direct Deposit Policy

At first, the IRS employed direct deposit as the main method for sending stimulus funds to those who qualify. Direct deposit offers many advantages, including faster access to money, improved security, and less processing times compared to physical checks.

Direct deposit allows IRS IRS access to a wider population efficiently since it guarantees that the funds are directly transferred to the bank accounts of those who are eligible. This simplified approach greatly reduces the chance of delays in payment and the potential problems with the loss or theft of checks.

2.When Did the Change Happen?

Like any other government program, policies can change based on different aspects, such as the changing environment and the need to improve the distribution of stimulus funds. The precise date on which the IRS was able to stop direct deposit of stimulus checks may differ in accordance with the round of payments and the current economic environment.

For accurate and current information, it is essential to directly refer to the authoritative IRS guidance and announcements. Government agencies such as the IRS often publish press releases and news updates on their official site, which is the best source for details regarding changes to policies.

3. Factors Behind the Policy Change

While we strive to give accurate information about what date the change in policy, It is important to comprehend the motivations for these policies. Many factors could be behind the change in IRS policies on direct deposit of stimulus checks.

- Equitable Distribution: The Equitable Distribution IRS continuously analyzes what is the fairest and most effective ways to distribute stimulus funds to all eligible recipients. As the program grows and more people become eligible for the program and benefits, the IRS could alter its methods to ensure a fair distribution.

- Improved Security Measures: Although direct deposit is convenient and provides speed, fears about security and fraud could prompt the IRS to reconsider its methods of payment. Modifications to the policies could mean adding additional security measures to protect the funds of taxpayers.

- Resolving Administrative Issues: Large-scale stimulus programs require complex administrative processes. The IRS can alter its policies to simplify operations and address any logistical difficulties that might be encountered.

4. Current Alternatives to Direct Deposit

In spite of the change in IRS policies, It is important to be aware that taxpayers have a variety of options for receiving their stimulus benefits. Some of the most popular methods are:

- Paper Check Delivery Paper Check Delivery: The IRS can send stimulus checks by mail to the address listed that is on file for recipients who are eligible. While this method can be slower to get the checks to recipients, it is still an alternative for those who want direct deposit.

- Credit Cards Prepaid: in some circumstances, the IRS could issue stimulus payment via debit cards prepaid, giving recipients the ability to access a secure method of receiving their money.

When Do Huntington Bank’s Deposit Checks For Stimulus? / When Will They Be Available?

Stimulus checks, also known by the name of Economic Impact Payments, are financial aids that are provided through the federal government for individuals who are eligible to help the economy grow during times of economic crisis. The purpose of these checks is to ease financial burdens and help households meet their basic requirements. Knowing the eligibility criteria and the process for the distribution of stimulus checks is vital to know when you’ll receive your check.

1. Eligibility and Requirements

In order to receive a stimulus payment from Huntington Bank, you must satisfy certain eligibility requirements set by the federal government. In general, those who have filed taxes for the relevant year and have met the income thresholds can be eligible to receive these checks. Certain eligibility requirements may vary depending on the stimulus round being implemented, and it is therefore essential to be informed of the latest information through reliable resources.

2. Stimulus Check Distribution Process

The process of distribution for the stimulus checks consists of several phases, and a variety of aspects are involved. When the government announces the new stimulus plan, banks like Huntington Bank are tasked with processing and distributing the funds to those who are eligible. The process may take a bit of time due to the vast amount of recipients and the necessity to ensure accuracy.

3. Factors Affecting Stimulus Check Arrival Time

Many factors could affect the timing of when your stimulus check to show up on the account of your Huntington Bank account:

IRS Processing Time

The Internal Revenue Service (IRS) is charged with processing stimulus payments and their effectiveness in managing the affluence of them can impact the timeframe of payments. The delays can occur in peak times as the IRS is overwhelmed with requests.

Bank Processing Time

When the IRS receives the money, the funds are then given to banks in individual accounts for distribution. Huntington Bank, like other banks, will have their own procedures, and the time required by the institution to transfer the funds to your account may differ.

Payment Method

The method you select to receive your stimulus payments can have an impact on the timing of its arrival. Direct deposit usually takes longer when compared to receiving physical checks through mail because electronic transfers are faster as well as more effective.

Eligibility Verification

In certain situations, further verification may be needed to verify an individual’s eligibility to receive the stimulus. The verification process could cause some delay in the delivery of the money.

Tracking Your Stimulus Check

To ensure you are updated on your status on your stimulus check to keep you updated on your status, the IRS provides an online tracking system dubbed “Get My Payment.” This tool lets you examine whether you are in the process of making your payments as well as the payment method and find out the expected delivery date. Huntington Bank might also provide updates via its online banking portal or its customer care channels.

4. Essential Tips to Expedite Stimulus Check Arrival

The timeframe for the arrival of stimulus checks is largely dependent on external factors, but there are a few ways you can help speed up the process:

Ensure Accurate Information

Check that the information you provide for your taxes is complete and current. Incorrect information or mistakes could cause delays in the processing of your tax refund.

Opt for Direct Deposit

If you don’t, you should consider direct deposit as the preferred method to receive the stimulus cash. This will allow you to skip the possible delays that come with postal mail.

Stay Informed

Be informed of the latest news on stimulus checks via official government websites as well as reliable news sources. Staying informed of any changes or announcements can help keep your expectations in check.

FAQs:

When will Huntington Bank deposit stimulus checks?

The timing of stimulus check deposits is determined by the IRS and the government. Banks like Huntington Bank receive and process stimulus payments based on the information provided by the IRS.

How do I know when my stimulus check will be deposited?

The IRS typically provides updates and information on stimulus check distribution through their website and official communications.

Will my stimulus check be directly deposited into my Huntington Bank account?

If you have provided your direct deposit information on your tax return or through the IRS portal, your stimulus check will likely be directly deposited into your Huntington Bank account.

Can I check the status of my stimulus payment?

The IRS offers an online tool called “Get My Payment” that allows you to track the status of your stimulus payment and see if it has been sent or scheduled for deposit.

What should I do if I haven’t received my stimulus check?

If you believe you are eligible for a stimulus check and haven’t received it, check the “Get My Payment” tool on the IRS website for updates. You can also contact the IRS or consult a tax professional for further assistance.

Are there any specific requirements for Huntington Bank customers to receive the stimulus check?

Generally, as long as you meet the eligibility criteria set by the government and have provided accurate direct deposit information, you should receive the stimulus check.

Will Huntington Bank notify me when I receive the stimulus check?

Huntington Bank may provide notifications through their online banking or communication channels, but the primary source of information is usually the IRS and their official updates on stimulus payments.