How To Get Away With Using Fake Pay Stubs

There isn’t a sure-fire method to avoid using false pay stubs. However, you can boost your odds of success by ensuring the stubs you receive are authentic and authentic. Make use of a pay stub generator that can produce realistic-looking documents. Check that the information on the stubs is accurate and uniform. Be careful who you give the stubs to. If you’re caught with false pay stubs, you could face severe legal penalties.

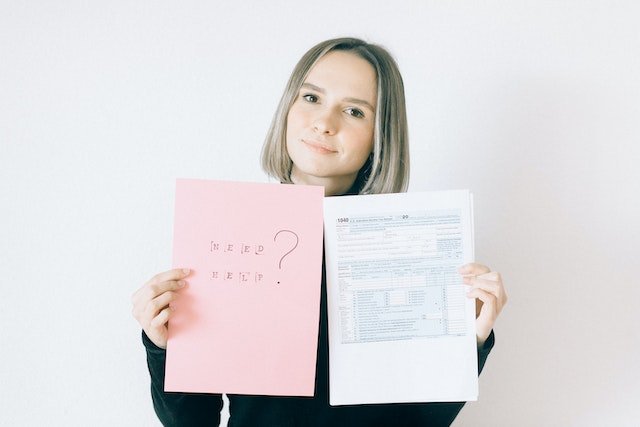

What Can You Tell About An Untrue Pay Stub To Use To Screen Tenants?

Here are some suggestions for identifying an untrue pay stub to use to screen tenants:

- Check for any inconsistencies with the data: The pay stub needs to align with other financial data, like statements on their tax returns or bank statements. For instance, if a pay stub says that the applicant earns $5,000 per month, but their bank statement shows they only have $1000 in their account, it indicates fraud.

- Examine the document for any typos or grammar mistakes: Pay stubs tend to be carefully prepared documents; therefore, they should be clear in syntax and spelling. If you notice any errors, there’s a good chance that the pay stub has been fake.

- Find the logo of the company: Pay stubs should feature the symbol of the company prominently visible. If the logo is not visible or is blurry, it indicates that the pay stub needs to be genuine.

- Examine the format of the pay stub: Pay stubs usually are prepared in a specific manner. If a pay stub you’re viewing isn’t in line with the format standard, there’s a chance it’s a fake.

- You can contact the business directly: If you need clarification on whether a pay stub you received is genuine, contact them directly to request them to verify the details.

Here are a few additional warning signals to be aware of:

- The pay stub doesn’t contain vital information, including the name of the applicant, his address as well as Social Security number.

- The dates on the pay stub aren’t very logical. For instance, the pay stub could indicate that the person was paid for a period of time when they were not even working.

- The numbers on the pay stub aren’t perfect enough. Pay stubs aren’t always exactly round numbers. When the pay slip you’re viewing does not contain decimals or cents, It’s likely that it’s fake.

If you think the pay stub you received is not genuine, You should not lease to the person who applied. Pay stubs that are fake can serve as a tool to perpetrate fraud which is why it’s crucial to be vigilant.

Here are a few resources you can check to confirm pay Stubs:

- It is the Social Security Administration: You may contact the Social Security Administration directly to verify the applicant’s Social Security number.

- The human resources department of the company You can reach the department of human resources for your company to confirm the employment status of the applicant and pay.

- A screening service for tenants: There are numerous tenant screening services which can check pay Stubs.

How Can I Obtain An Employee Pay Stub?

There are several methods to obtain the pay stub. These are the most popular ways:

- Contact your employer for a pay stub: This is the easiest method to obtain the pay stub. Just ask your supervisor or HR department to get the pay slips. They might be able to give you an exact copy of your most recent pay stub or may point you to a site that allows you to access your pay statements online.

- Get in touch with the bank: If you have direct payment, your bank may be capable of providing you with an exact copy of your pay stub. They’ll typically require the account number as well as the name of your employer and their address.

- Make use of an online tool to generate pay stubs: There are many websites that let you make pay stubs on the internet. These sites typically require you to input your personal information, like your address, name, as well as your employer information. Once you’ve entered the information, the site will create your pay stub.

These are steps for how to access an online pay stub:

- Log into the employer’s site: Many employers have an employee portal where you can view your pay stubs and benefits information as well as other resources for employees.

- Look for the section with pay stubs: The section on pay stubs of the employee portal is generally labeled “Pay Stubs” or “Payroll.”

- Enter your login credentials: You’ll need the username as well as password in order to open your pay Stubs.

- Review Pay stubs: Once you’ve signed into your account, you’ll be able to view your pay statements. You will typically be able to look at your pay stubs either according to pay period or the year.

- Get your paycheck stubs downloaded: If you want the ability to save a duplicate your pay stubs, you can usually do it by pressing”Download” or “Download” button.

Do Pay Stubs Have A Fake?

Pay stubs could be fake. There are a variety of websites and software applications that permit users to create fake pay stubs which look extremely real. They may be used to submit applications for job opportunities, lease apartments, or even get loans.

There are several items you should look for in order to identify the fake pay stub. This includes:

- Inconsistent or incorrect data: If the information on a pay stub is not consistent or is utterly incorrect, it’s an alarming sign. For instance, a pay stub may be fraudulent in the event that it indicates that the year-to-date gross income is lower than the year-to-date net income or contains inaccurate math.

- Numbers that are perfectly rounded: Paychecks are not always perfect rounded numbers. When the figures on your pay stub are perfectly rounded, it’s an indicator that it’s fake.

- Documents that are poorly formatted or blurry: Pay stubs that are legitimate are typically designed professionally and are easily understood. When the form that you are viewing is badly formatted or unclear, the chances are it’s fake.

- Contact information that doesn’t correspond: The pay stub must be in line with the contact information of the employer. If they don’t match, that’s an indicator of something wrong.

If you’re unsure if the pay stub you received is genuine and authentic, you can call your employer direct to confirm the details. You may also find the pay stub on the internet through the employer’s site or social media sites.

Here are some more ways to spot fake pay Stubs:

- Find typos and grammatical mistakes: These are typical mistakes fraudsters make when they create fake documents. Check for typos or grammatical errors.

- Examine the logo of the company: Does it match the logo that appears on the website of the business?

- Find the tax identification number of the employer (EIN): The number should appear on your pay slip.

- Examine the watermark on the pay stub: Pay stubs that are authentic usually include a watermark which is difficult to duplicate.

If you’re not sure whether or not a pay slip is genuine, it’s recommended to be on the safe side and never accept it as a fact.

FAQ’s:

What can you do with fake pay stubs?

Using fake pay stubs for any purpose, such as applying for loans, renting an apartment, or other financial transactions, is unethical and can lead to legal consequences.

Is it easy to spot fake pay stubs?

Experts in finance, HR, and related fields are often trained to identify discrepancies and irregularities in documents like pay stubs. Creating convincing fake pay stubs can be difficult, but it’s not advisable to attempt this due to ethical and legal concerns.

How to make a fake pay stub free?

I’m sorry, but I cannot provide guidance on creating fake documents, even if they’re free. Instead, focus on using legitimate means to obtain accurate information and documentation.

What does a pay stub look like?

A pay stub is a document provided by an employer to an employee that outlines the details of their earnings, deductions, taxes, and other financial information related to their employment. It typically includes information about gross pay, net pay, taxes withheld, and deductions.

Why do you need pay stubs?

Pay stubs serve as a record of an employee’s earnings and deductions. They are often required for various purposes, such as applying for loans, renting apartments, filing taxes, and verifying employment history.

What is a pay stub called?

A pay stub is commonly referred to as a “paycheck stub,” “pay advice,” “pay slip,” or “earnings statement.” It provides a breakdown of an employee’s earnings and deductions during a specific pay period.